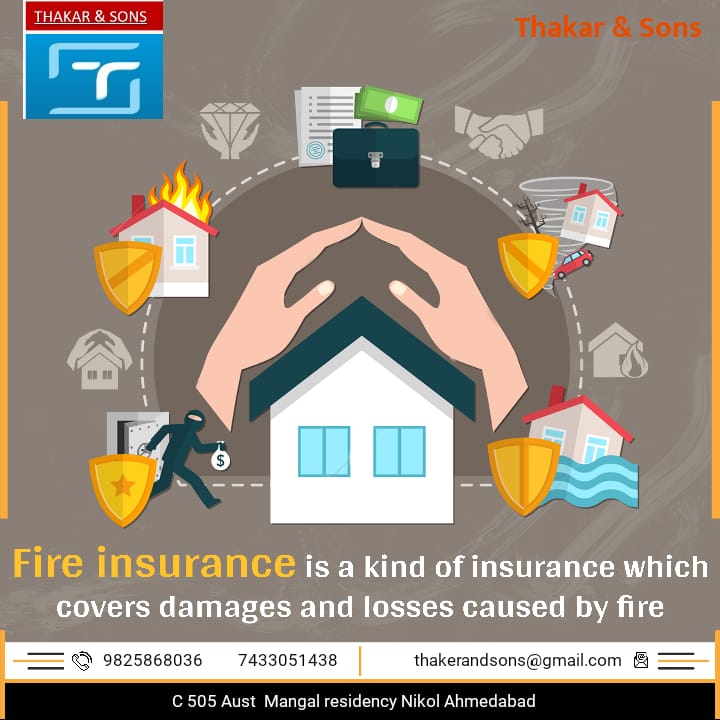

Welcome to Thakar & Sons

As defined above, an insurance policy is a legal contract that binds both policyholder and the insurance company towards each other. It has all the details of the conditions or circumstances under which either the insured individual or policy nominee receives insurance benefits from the insurer.

Insurance is a method by which you can protect yourself and your loved ones from facing a financial crisis. You buy an insurance policy for the same, while the insurance company takes the risk involved and offer insurance cover at a specific premium.